York County Pa Assessment Database

York County

Welcome To York County Property records Search Important: This site provides access to the assessment office property records database in York County, Pennsylvania. You can access public records by searching by property owner, street address, or parcel ID. Basic Search (Owner, Parcel, Address) Advanced/Sales Search Map Search Disclaimer: The County of York makes no representations or warranties as to the suitability of this information for you...

https://assessmentpublic.yorkcountypa.gov/

York County

Disclaimer DISCLAIMER AND WAIVER OF LIABILITY The data found on the York County Assessment Office websites and portals has been produced and processed from sources believed to be reliable. Users of this system assume all risks associated with its use, including the risk that damage may occur to user computer systems, software or data stored on or contained in user computer systems.

https://assessmentpublic.yorkcountypa.gov/search/commonsearch.aspx?mode=realprop

Property Tax Information - City of York, Pennsylvania

Each year the City Council and the York City School Board establish a tax millage. This millage, when multiplied against the assessed value of your property, results in the Face tax due. State law allows for a 2% discount, if taxes are paid within 60 days and a 10% penalty, if taxes are not paid within 120 days (Penalty).

https://www.yorkcity.org/resident/property-tax-information/

Real Estate Assessment York County, VA

Real Estate Assessment All real property in York County is appraised and assessed on a biennial basis, effective January 1, on even numbered years, by the Real Estate Assessment Office. Real estate assessments, in York County, are conducted on a biennial cycle, and as part of the 2026 reassessment, staff are reviewing sales, updating photographs and reviewing previously issued building permits.

https://www.yorkcounty.gov/363/Real-Estate-Assessment

YOUR GUIDE TO THE REASSESSMENT PROGRAM 2025

All property appraised by the York County Assessor has been classified ... Example: For tax year 2025, file between January 1, 2025 and. January 15, 2026.

https://www.yorkcountygov.com/152/Reassessment-Program-PDFYork County PA GIS Portal

Welcome to the Geographic Information Systems (GIS) Portal of York County, Pennsylvania where you can explore and download mapping data, discover interactive apps and more. Its a one stop shop for everything mapping related in York County, Pennsylvania. Map Requests York County Planning Commission handles the majority of map requests for the county.

https://york-county-pa-gis-portal-yorkcountypa.hub.arcgis.com/

Millage Rates York County, PA

This website is AudioEye enabled and is being optimized for accessibility. To open the AudioEye Toolbar, press "shift + =". Some assistive technologies may require the use of a passthrough function before this keystroke. For more information, activate the button labeled “Explore your accessibility options”.

https://yorkcountypa.gov/515/Millage-Rates

York County

The York County Assessor’s Office will be CLOSED on Monday, January 19, 2026 in observance of the Martin Luther King, Jr. holiday. --- 12/29/2025 --- The York County Courthouse will be CLOSED Thursday, January 1st, 2026 in observance of the New Years holiday.

https://york.nebraskaassessors.com/

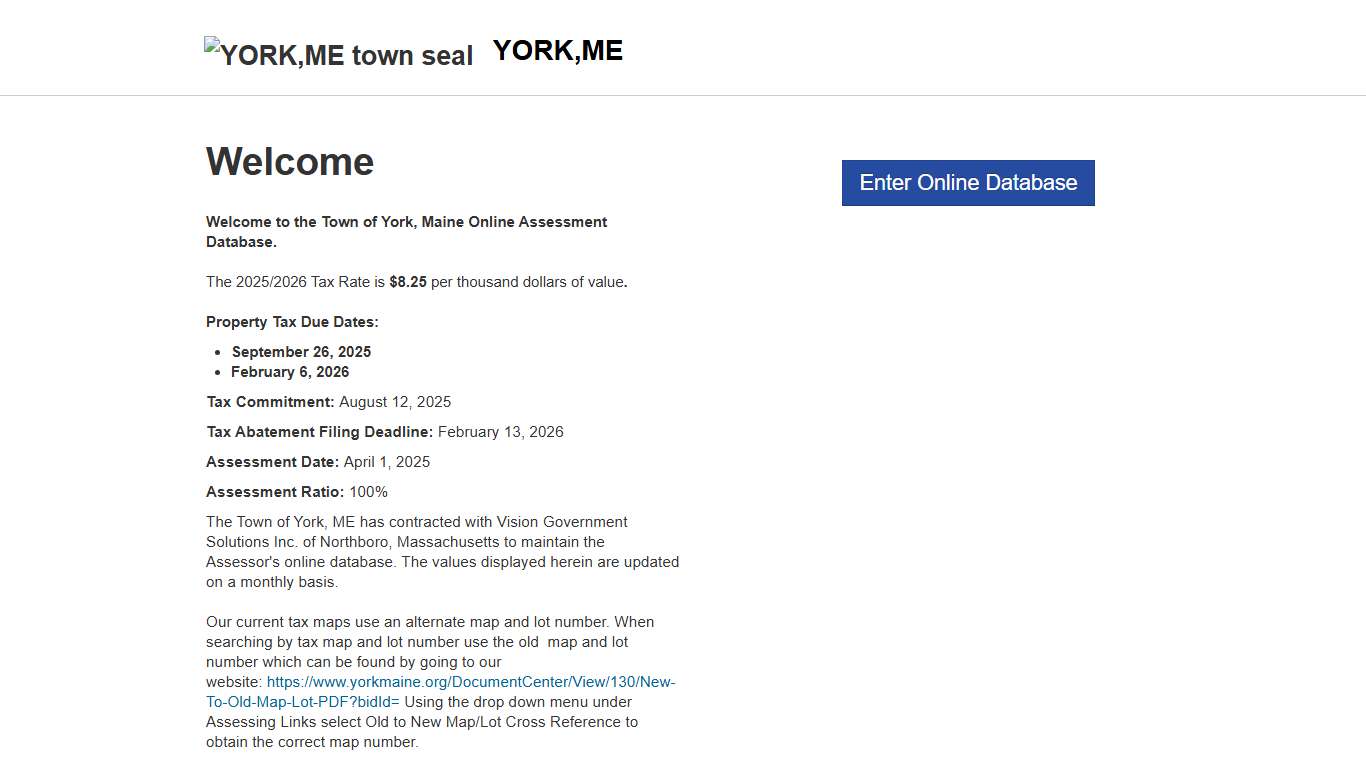

Vision Government Solutions

Welcome to the Town of York, Maine Online Assessment Database. The 2025/2026 Tax Rate is $8.25 per thousand dollars of value. Property Tax Due Dates:...

https://gis.vgsi.com/yorkme/

Tax Assessor York, ME

Tax Assessor Here is a brief explanation of how the tax rate is calculated. For more information feel free to contact our office at (207) 363-1005 or email [email protected]. __________________________________________________________________________ The Town of York’s 2025/2026 taxable valuation is $8,348,628,440. This includes taxable real estate valuation of $8,318,958,600 and taxable business personal property valuation of $29,669,840.

https://www.yorkmaine.org/152/Tax-Assessor

York County... - WGAL News Channel 8 Susquehanna Valley, Pa. Facebook

York County approves tax increase with 2026 budget to close $27 million deficit York County commissioners have approved a 2026 budget that includes a tax increase to address a $27 million deficit, despite efforts to reduce the initially proposed rate.

https://www.facebook.com/wgal8/posts/york-county-commissioners-have-approved-a-2026-budget-that-includes-a-tax-increa/1301225895378482/

Tax Assessor York, ME

Tax Assessor Here is a brief explanation of how the tax rate is calculated. For more information feel free to contact our office at (207) 363-1005 or email [email protected]. __________________________________________________________________________ The Town of York’s 2025/2026 taxable valuation is $8,348,628,440. This includes taxable real estate valuation of $8,318,958,600 and taxable business personal property valuation of $29,669,840.

https://www.yorkmaine.org/152/Tax-Assessor

NETR Online • York • York Public Records, Search York Records, York Property Tax, Pennsylvania Property Search, Pennsylvania Assessor

Select: York County Public Records The Keystone State York Treasurer (717) 771-9603 York Recorder of Deeds (717) 771-9295 York Assessor (717) 771-9232 York NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/PA/county/york

Welcome to MPAC MPAC

To give you the best experience on our website, we may use cookies and pixels to track visits and interactions, optimize our services, personalize content and to keep the site secure. Cookies and pixels do not contain personally identifying information and do not give MPAC access to anything on your device.

https://www.mpac.ca/en

Vision Government Solutions

Welcome to the Town of York, Maine Online Assessment Database. The 2025/2026 Tax Rate is $8.25 per thousand dollars of value. Property Tax Due Dates:...

https://gis.vgsi.com/yorkme/

Parcels [Pennsylvania--York County] - Big Ten Academic Alliance Geoportal

The Parcel GIS Layer for tax assessment is a high-resolution geospatial dataset that defines property boundaries and integrates detailed tax-related attributes within a Geographic Information System (GIS) environment. Each parcel is represented as a polygon feature in a vector data format, accurately georeferenced using standardized coordinate systems (e.g., NAD 1983, State Plane or UTM), and maintained through cadastral mapping practices.

https://geo.btaa.org/catalog/803b4da39e7b457ab6e7a5eeb3410abb_0![Parcels [Pennsylvania--York County] - Big Ten Academic Alliance Geoportal](screenshots/york_county_pa_assessment_database_17.jpg)

York County Council Workshop January 13, 2026 - YouTube

If playback doesn't begin shortly, try restarting your device. • You're signed out Videos you watch may be added to the TV's watch history and influence TV recommendations. To avoid this, cancel and sign in to YouTube on your computer. CancelConfirm Share An error occurred while retrieving sharing information. Please try again later.

https://www.youtube.com/watch?v=C0w_4IJuXpM

Property Taxes by State and County, 2025 Tax Foundation Maps

Property taxes are the primary tool for financing local governments. In fiscal year 2022, property taxes comprised 27.4 percent of total state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

https://taxfoundation.org/data/all/state/property-taxes-by-state-county/